LEGAL NOTICE

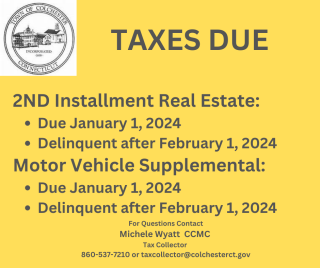

Notice is hereby given to the Town of Colchester taxpayers that Motor Vehicle Supplemental taxes and the second installment of Real Estate taxes on the Grand List of October 1, 2022 are due and payable on January 1, 2024. The second installment bill for Real Estate taxes was mailed in October 2023. No additional bills for the second installment for Real Estate taxes will be mailed.

Taxes not paid in full on or before February 1, 2024 become delinquent and are subject to interest at the rate of 1 ½% per month or 18% annum, from the due date of the tax, as required by Conn. Gen. Stat. 12-130,145 and 146. Mail postmarked (US Postal Service postmark only) on or before February 1, 2024 will be considered as having been paid on time. Payments dropped in the town hall’s drop box after 4:30p.m. on February 1 ,2024, will be considered as having been made on the following business day and will be deemed as paid late.

Failure to receive a tax bill does not invalidate the tax or any interest charged should the tax become delinquent. If you did not receive a bill and think you should please contact the office immediately. Conn Gen Stat. 12-130

Please make all checks payable to the Tax Collector and mailed to: Tax Office, 127 Norwich Avenue Colchester, CT, 06415. If a receipt is desired, please send a self-addressed stamped envelope and two copies of the bill. Pay on-line by visiting our website www.colchesterct.gov; FEES APPLY. Hours of collection are Monday – Wednesday and Friday 8:30am – 4:30pm; Thursday 8:30am- 7pm. Questions concerning tax payments should be directed to the Tax Office, (860) 537-7210.